The state of accounting firm technology use today

If the process of preparing your accounting firm for the future, and moving away from traditional, error-prone, and time-consuming paper-based processes seems daunting to you, you’re not alone. In fact,

Nearly one-fifth (18%) of accountants were still using paper ledgers in 2017 — The Remote Advantage

Old habits die hard, but looking beyond the obvious security and storage problems inherent in paper files, the problem of relying on them has been highlighted in firms around the world since the pandemic started. Thankfully, accounting firm practice management technology can make moving your firm from manual to automated processes simple, efficient, and most importantly — impactful on your bottom line.

What is accounting firm technology?

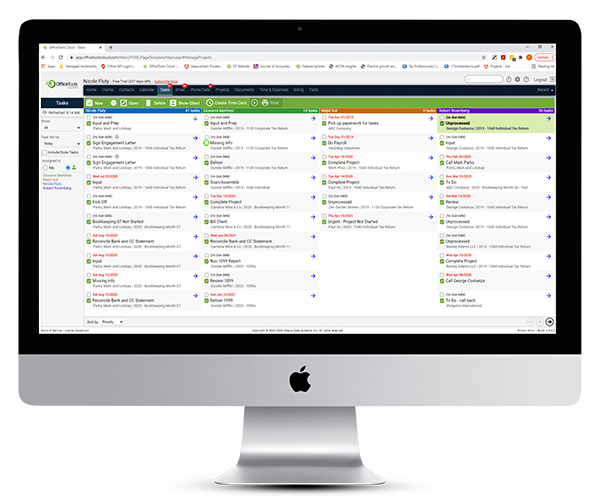

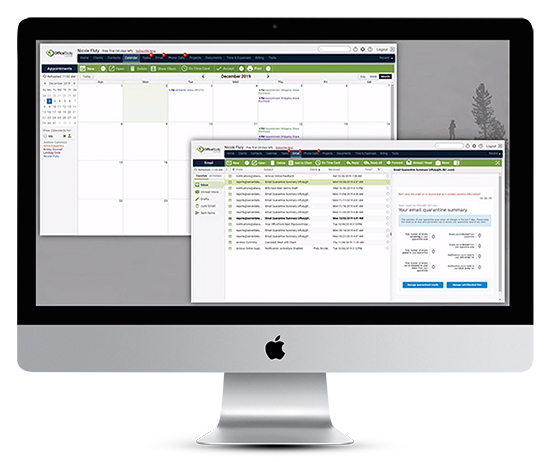

Accounting firm technology solutions, specifically practice management software, refers to technology designed to increase your firm’s productivity. The best accounting tech streamlines accountant workflows with a centralized database that includes flexible client management, calendaring, task tracking, and much more.

When it comes to modern accounting firm technology, the range of capabilities is vast. Modern practice management software is designed to address inefficiencies in nearly every process and task imaginable: From automating specific activities like time and billing, to tackling the more involved manual tasks that come with managing your firm, the available options can be overwhelming to navigate.

Your 60 second accounting firm technology guide

How to run a modern accounting firm

The best way to manage your firm is to rely on a cloud-based accounting practice management software to take care of non-billable firm activities. But, with vastly different strengths, weaknesses, and applications, it’s clear that not all accounting technology solutions are created equal.

Customer relationship management (CRM) software manages your relationships with clients and potential customers alike, helping your firm maintain a healthy pipeline while making intake form data entry and prospecting easier.

Task management tools generally allow you to manage an entire firm’s tasks from a central location. They should enable you to track due dates, set reminders, and see who’s taking care of what projects.

Modern time and billing programs track time easily and efficiently while giving a more accurate look into your firm’s operations. Whether you’re looking to track and manage productivity levels or assess client profitability, these solutions simplify the tricky business of tracking time.

Today’s accounting workflow tools are all about automation. 69% of workers said that automation would give them more time to carry out their primary duties.Automated processes have the potential to transform accounting as a profession, reducing the time spent on routine manual tasks and giving your team more time to focus on work that adds value to the firm.

Choosing the right accounting technology software

Accounting firm technology and productivity go hand-in-hand. Before you map out your digital roadmap, consider your staff’s needs, client’s needs, and firm’s needs when making important decisions about the future of your accounting tech

Taking initiative on the following four steps will make sure you’re selecting the right accounting practice management software to invest in:

Conduct a needs assessment to identify gaps between existing and desired technology

Don’t skip this step! This will help you determine everything you need and want from your technology solution(s). Discuss and identify your pain-points and bottlenecks. Review where time is being spent and determine what processes can be automated.

Set clear goals for what your firm’s accounting technology should accomplish

Are you looking to increase your number of billable hours? Improve virtual communication and collaboration while your firm works remotely? Think about what the ROI on your technology investment looks like.

Ensure you have access to the proper hardware needed

Take stock of what hardware you have. Is everyone equipped with the computers, laptops, and/or tablets they need to run the accounting technology you choose? This includes making sure they have the proper cybersecurity software installed on their devices.

Create a data migration plan

Because of the typical time and effort required, data migration can be a major concern for some accounting firms. Fortunately, working with an experienced cloud solutions provider is one of the best ways to painlessly navigate the data migration process. They can help minimize firm disruption and maintain data quality in the transition to a new practice management system.

How can your firm best leverage accounting technology?

To thrive today and in the future, accounting firms must support remote work, secure their data, and cater to client convenience.

7 questions to ask yourself

Technology has never been a more integral part of running and growing an accounting firm, but before settling on an accounting tech solution, ask yourself these seven questions:

Are there opportunities to streamline operations and reduce costs through automation?

Workflow automation will reduce manual errors and improve compliance and efficiency. By digitizing workflows, your staff can focus on profit-driving work rather than spending hours on administrative upkeep.

Does your current tech stack make it easy to stay compliant with new legislation and data privacy requirements?

State and federal regulations continue to evolve, with new bills and requirements for specific regions and types of data. To ensure your firm secures and transmits data correctly, choose a solution that does the heavy compliance lifting for you.

Can you support remote staff?

In the new version of normal, your staff and partners are likely to work from a variety of locations – and use different operating systems and devices. The easiest way to reduce friction and productivity delays while unlocking remote access to firm resources is moving to the cloud — with no IT specialist needed.

Is your client and financial data secure?

Collecting, storing, and sharing sensitive data is critical. One breach can put a practice out of business. Look for a solution that offers secure client communication and document exchange with AES 256-bit encryption of data in transit and at rest. Role-based access to client/case information starting with the “zero trust” model is also a must.

Do you have the tools to build a strong virtual client relationship?

Traditionally, accounting firms deliver a high touch service model, now we are forced to rethink that service model and adapt it to our new normal. Offering an exceptional online client experience is a must to stay competitive. Secure client portals, web scheduling, 24/7 status updates, and digital document management enable you to provide the personalized service and security your clients need.

Do you offer electronic payment options?

Electronic billing is changing the game with both accounting firms and their clientele. Web, email, and mobile payment options make it easy for clients to pay invoices, while emailed invoices and payment reminders can accelerate collections for your firm.

Does your practice management solution integrate with other tools?

Integration with popular platforms like QuickBooks, Lacerte, Office 365 and other tools reduces duplicated work and the need to jump between systems. Staff can work faster and deal with one shared database while simplifying workflows.

Make sure your solution is tailored to your needs

Disparate technologies aren’t effective. A patchwork of different tools each designed for a different function is costly, overly complex, and ineffective.

Your accounting firm technology should handle most or all the functions you need to manage your firm

Depending on your practice, size and budget, your firm has unique needs. Your best bet is to invest in a cloud-based accounting firm practice management solution that is robust enough to deliver everything you need, such as:

- Calendaring

- Workflow automation

- Mail integration

- Accounting capabilities

- Automated document management

- Billing and time tracking

- Secure anywhere/anytime access

It should be completely comprehensive, has integration capabilities, can be customized, includes data analysis and reporting, and helps you solve your firm’s challenges.

With OfficeTools, you get your choice of a private, public, or hybrid cloud environment or on-premise options, plus experts who can analyze your needs and design a customized bundle. Take our short quiz to see which OfficeTools accounting tech is right for your firm, or contact us to talk to someone directly.