5 Ways Accepting Recurring Payments will Change Your Business for the Better

As accountants transition away from hourly billing and switch to flat fee or value-based pricing models, the need for having after-the-fact invoices is almost rendered unnecessary. Previously, you would work and then bill the client for time spent; now you know what the bill is going to be before the work is done. Not only do you know the fee but, if you’re like me, you invoice in advance: April invoices are now due April 1st, not May 15th. Trying to figure out payment schedules and track your accounts receivable, with different clients on different pay schedules, can be incredibly tedious. You probably know businesses that accept recurring payments through Quickbooks, Paypal, Stripe, Venmo, Zelle and/or Cashapp, and while there’s nothing wrong with using multiple systems, having money coming in from every direction can be incredibly difficult to track.

All this to say, the idea of consistent, recurring billing can significantly simplify your life and your business practices, and furthermore, auto-recurring payments could make your workflow even more seamless.

Benefits of Moving to Recurring Payments

Here are five ways accepting auto-recurring payments can help your firm.

1. Always get paid

Have you ever spent hours reviewing a prospective client’s books, created a procedure to clean up their books and/or a proposal for ongoing business, just for them to walk away or not pay you?

Or do you have any of those clients that take three months to pay their bills…and that’s after two phone calls and four reminder emails?

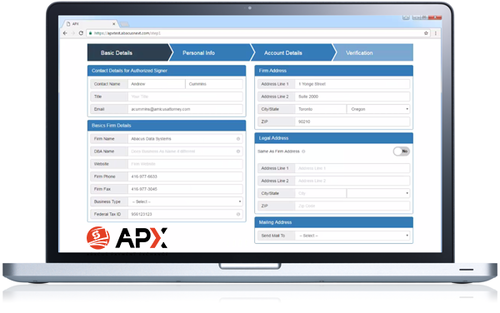

With auto-recurring payments, that’s a thing of the past. Not only do you always get paid, but you get paid quickly, usually within a few business days. Once an automatic, recurring payment plan is set up, the money will automatically draft out of their account, or charge their credit card, without any action on their part (or yours). No more tracking down clients for collections. No more sending ‘this engagement is no longer working for me’ emails. And now, client collections just became a whole lot easier, thanks to Abacus Payment Exchange inside OfficeTools.

2. Save Time & money

Are you still manually running time tracking reports each month? Are you still spending time reviewing open invoices and emailing clients for collections? That’s so 2019. Once you have auto-recurring payments set up, there is no time spent reviewing open invoices, because there aren’t any. There’s no time spent running time-tracking reports, because you don’t need them. Are you paying an assistant to manage your accounts receivable? That’s a cost you no longer need to incur. Additionally, you don’t need to create invoices each month or record payments. Set them up once and they’re done. Everything is automated, and that’s one less thing on your to-do list. You’re not having to reconcile Zelle, Venmo, Paypal and Square, because there’s only one payment system.

Side note: Will clients still ask if they can pay you by check, Zelle or paypal? Possibly, but as an accounting professional who owns a business, you are the one who dictates how and when you get paid. You create workflows and tell your clients ‘this is how I do business’. Have you ever walked into Best Buy and asked if you could pay with Zelle? No. Because they, as a business, have dictated how they accept payments via their point-of-sale system. You are a business owner– you have that same authority.

Less tracking, more working.

Make billing your clients simple and easy. See how you can process credit card payments and ACH transactions from inside your practice management solution.

Make billing your clients simple and easy. See how you can process credit card payments and ACH transactions from inside your practice management solution.

3. Improve Client Relations

Have you ever had to have that awkward ‘you haven’t paid my last two invoices’ conversation? Has client collections, or lack thereof, ever spoiled your relationship with a client? Have you ever had to (or wanted to) fire a client over late payments?

None of these feelings or conversations are comfortable or enjoyable for you or the client. Why add any more stress to your business than you already have to have? By removing the ‘after-the-fact’ invoicing piece of the puzzle, you can have more seamless, pleasant relations with your clients, knowing that billing will never again have to be an awkward or unpleasant conversation. It’s already done.

4. It’s Easy for the Client

ACH? No problem. Credit Card? No problem. Does your client want to pay on the 15th instead of the 1st of the month? Sure thing. Accepting recurring payments makes your client’s life a whole lot easier, as it’s entirely automated and hassle free. They can set-it-and-forget-it. It’s one less bill for them to have to remember to pay and it removes the checkout process. You will no longer have to enter their payment information every billing cycle. It’s the same every month and there’s no worrying if they are going to have the cash flow.

Personally, as a customer, I leap at the opportunity to set up automatic payments. With auto-recurring payments, you can not only control the drafts, but also adjust when the payments are drafted. This can be a good option for clients who prefer to spread their bills throughout the month, coordinating payments with when they get paid, or for those who want to pay their quarterly invoice in weekly or monthly payments. Either way, it is one more convenience you can provide to your clients.

5. Keep Payment Information Secure

How many of your clients, against your advice, email bank statements, account information or social security numbers? Too many! Once you have auto-recurring payments set up, there is no sending payment information over email. The Abacus Payment Exchange inside OfficeTools gives you as business owners the ability to securely manage your client information. No e-checks or credit card numbers being sent over less-than-secure networks. Set it up once, and it’s done. Information is not only secure, but it’s kept, so there’s no need to send it each month or wait for checks in the mail.

Make your systems work for you. Replace your tedious, expensive, time-consuming processes with automated ones. Your bank account, team, clients, to-do list and bottom line will thank you.