Take your firm digital with eSignatures & the Client Portal

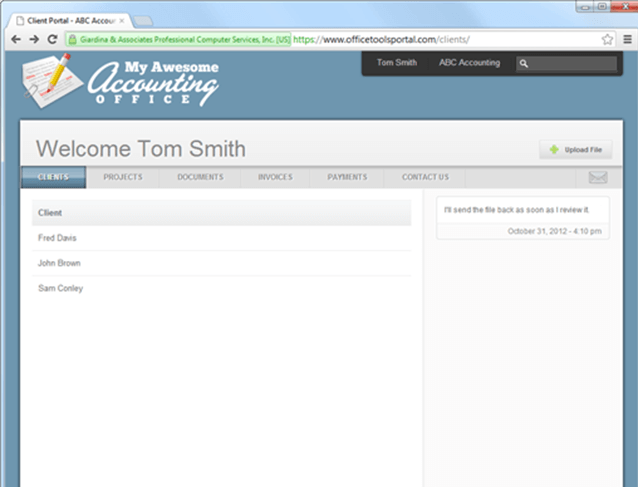

Send documents, accept payments, collect eSignatures, and more.

Connect with your clients digitally and improve your firm’s brand.

The Client Portal integrated in to OfficeTools WorkSpace sends documents, accepts and processes payments, offers online scheduling for tax appointments, handles in-lobby Kiosk Check-In, and collects eSignatures, questionnaires, and online time tracking.

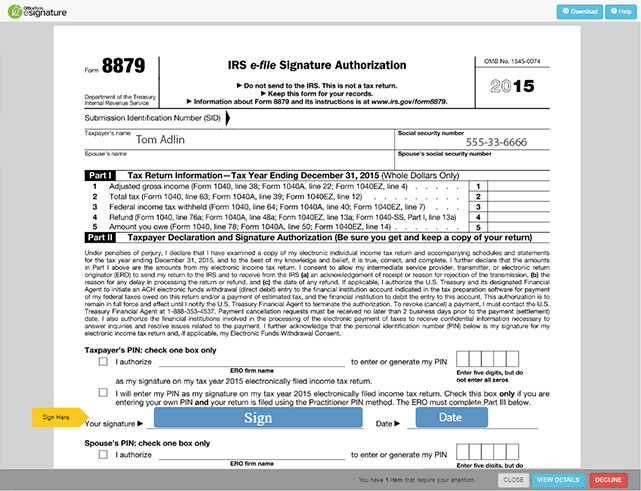

E-signature Tool

Keep your client document requests and related processes streamlined with our eSignature Tool available for all Officetools WorkSpace users! Built on digital signature requirements from the IRS, this fully integrated system combines workflow and document processing in a single click. Your clients will enjoy connecting digitally with your firm through the simple, safe, and secure method.

Appointment Requests

With the new appointment request and availability section your clients can request an appointment online for a specific staff member of your team. This is especially great for Tax Interview appointments. Client appointments will be confirmed, by the firm, directly from the WorkSpace™ calendars section and communicated from WorkSpace™ Portal via email and text. Auto remind your client multiple times to ensure your client arrives on time.

Lobby Kiosk

The Client Intake/Check-in System allows clients to change basic contact information from your OfficeTools database, through the Client Portal. No more clipboards and re-keying information. Update from the firm’s lobby when checking-in at the reception area. Add a simple customization tax questionnaire to the process for both lobby and online clients. All information automatically updates your OfficeTools database.

Online Time Sheets

In these times, who doesn’t need remote access to key-in time for payroll or billing? Two time views, daily or weekly are available to streamline key punching. All time is synchronized within OfficeTools WorkSpace for purposes of reporting, payroll and client billings. The new Online Staff Time Sheets adds new Mobile value to your firm. Your team will love it.

“It has changed our firm, it is just wonderful. Being able to know in the process where we are with tax returns, find the files, have good metrics about where we’re spending our time, and overall managing our practice has made a huge impact. We’re just thrilled.”

Simplified Project Management

Workflow and projects can change daily, that’s why we set out to make project management simple yet flexible enough to cater to your ever changing needs all with the ease of a click.

Client Messaging

Clients can message you directly from WorkSpace™ Portal with any questions or concerns. Messaging is especially useful when missing additional information or documents.

Integrated Practice Management Features

WorkSpace form letters provide mass document signing for engagement letters. You can directly send and retrieve Multi-Party and Sequential signing documents like 8879’s inside WorkSpace and every completed document is automatically stored in our document storage system.

Meets all Compliance Requirements

Strict adherence to the eSign Act guidelines, including document trail requirements and complies with the IRS Knowledge Based Authentication.

Simple Administration and Secure

Every transaction is easily reviewed in our Manage dialogue with the ability to engage those who have not completed document signing. Using 256-bit encryption to ensure the confidentiality of transmitted data.

Integrated Practice Management

Sending documents and messages to clients within WorkSpace™ is simple and integrates with your daily workflow.

Invoices and Payments

Clients can easily pay without leaving your branded portal, increasing customer confidence.

100% Custom Branding

Clients will see your logo and tagline when they log in which helps extend your branding and marketing messages.

eSignature Features with OfficeTools WorkSpace and the Client Portal

Multiple parties can be specified as signers on a single document. eSignature accommodates dependents and alternate contacts who share a single email address. Multiple signers are setup to sign in order. Intermediate document versions are generated after each signature. Merge fields allows you to populate areas using the data from within WorkSpace. The text merges into the document before sending. A reusable template combines a document with signature fields, date fields, initial fields, print fields, and merge fields. An administrator sets up the template once, and users may send it repeatedly. Need to send an engagement letter to multiple clients or a subset of multiple clients? Choose a Form Letter Template and choose your clients with our client selection filters. An email is sent to the sender and all signers when a document is completed. A copy of the completed document is sent to all parties involved. A copy of the document is also automatically downloaded into WorkSpace if you choose to.

Document Trail

Every document includes an eSignature Document Trail with court-admissible validity data, including the audit log and each party’s name, email, signature, IP address, and other identity information.

Knowledge Based Authentication

You can set up knowledge based authentication as part of the signing process. Each signer will then have to pass those requirements before being allowed to access the document. Knowledge based authentication results are included in the document trail for an audit of identity verification.

UETA and ESIGN Act Compliance

We have recognized the major requirements that constitutes a valid electronically signed document, which are:

- Intent to sign – Electronic signatures are only valid if the signer had intent to sign

- Logical Association – ESIGN Act and UETA specifies that a valid electronic signature must be logically associated with the document by the person with the intent to sign.

- Consent to electronic records – Records are stored electronically and available for all involved parties.

We adhere to the current IRS Electronic Signature Guidance

That means our compliant eSignature software solution must record the following data:

- Digital image of the signed form;

- Date and time of the signature;

- Taxpayer’s computer IP address (Remote transaction only);

- Taxpayer’s login identification – user name (Remote transaction only);

- Identity verification: taxpayer’s knowledge based authentication passed results and for in person transactions, confirmation that government picture identification has been verified;

- Method used to sign the record,(e.g., typed name); or a system log; or other audit trail that reflects the completion of the electronic signature process by the signer.

Security

The datacenter for WorkSpace™ Portal is maintained by Rackspace Hosting which has completed an examination in conformity with Statement on Auditing Standards No. 70 (SAS 70 Type II and SOC II). WorkSpace™ Portal uses 256 bit encryption using HTTPS secure protocol and is also FINRA and HIPPA compliant. Completion of the examinations indicates that selected Rackspace’s processes, procedures and controls have been formally evaluated and tested by an independent accounting and auditing firm. The examination included the company’s controls related to security monitoring, change management, service delivery, support services, backup and environmental controls, logical and physical access. SAS 70 is designated by the U.S. Securities and Exchange Commission (SEC) as an acceptable method for a user organization’s management to obtain assurance about service organization’s internal controls without conducting separate assessments. A service auditor’s examination performed in accordance with SAS No. 70 (SAS 70 Audit) is widely recognized, because it represents that a service organization has been through an in- depth audit of their control objectives and control activities, which often include controls over information technology and related processes. A Type II report not only includes the service organization’s description of controls, but also includes detailed testing of the design and operating effectiveness of the service organization’s controls. Extended Validation displays the green verified address bar in end user browsers. Our effective challenge response meets the IRS standards against web site attacks from malicious bots by using failed login lockout standards. In addition, we maintain physical, electronic and procedural safeguards that comply with applicable law and federal standards. See our Privacy Policy for more information.

Requirements

There’s no need to create an account to sign in. Signers just need to access their email on an internet connected device. eSignature is platform independent product viewable with leading web browsers.

Your client will need: Nearly any internet browser. We support Internet Explorer 9.0+, Firefox 3.6+, Google Chrome 16.0+ and Safari 3+. Internet Explorer 10+ is required for large file uploads.

You will need: OfficeTools WorkSpace 2016 or newer, a local email client (Outlook etc..) and a modern updated internet browser. The Tech stuff: Java, Java Scripting must be enabled, 256 encrypted browser setting with SSL 2.0 or 3.0 are required. Local Fire walls must allow SSL (https) communication and port 3306 must be opened for TCP.