According to a recent survey conducted by CPA.com, accounting firms that begin offering strategic advisory services can see monthly client revenues grow by as much as 50%. This shift presents a means of increasing revenues, but it also enables accounting firms to become more of a trusted advisor to their clients. The change will also increase customer retention over the long term since it enables accountants to provide more value to their clients and occupy a role that’s increasingly critical to their businesses success.

According to a recent survey conducted by CPA.com, accounting firms that begin offering strategic advisory services can see monthly client revenues grow by as much as 50%. This shift presents a means of increasing revenues, but it also enables accounting firms to become more of a trusted advisor to their clients. The change will also increase customer retention over the long term since it enables accountants to provide more value to their clients and occupy a role that’s increasingly critical to their businesses success.

In fact, research has shown the more likely a client is to describe their accountant as a trusted advisor, the less likely they are to switch to another CPA firm in the coming year. Offering strategic accounting advisory services also enables firms to move beyond hourly billing models towards fixed-fee or value-based pricing. This means that your team’s earning potential will no longer be constrained by the number of working hours in a day, week or month.

However, many accounting practices struggle to make the transition to new service models. Taking advantage of the opportunities they bring requires openness to change and a willingness to innovate. It also demands that you embrace technologies and systems that can facilitate the transition. And, it will necessitate a shift in how you think of yourself, as well as how you position your firm in your marketing.

Getting started: what kinds of strategic advisory services should you offer?

Many accounting firms would like to be able to offer more strategic advisory services to their clients, but aren’t sure where to begin. In many cases, examining your current book of business can guide you. Start by asking yourself what types of strategic advisory services you are already providing — perhaps without charge. Do you help clients with business formation? Do you advise them on when to obtain credit or bank loans? Do you help with cash flow management? Do you assist with processes like trademark applications?

Asking these kinds of questions will help you see what skills and capabilities your team already possesses. Next, you’ll need to think about how to translate them into formal offerings. Could you serve as a fractional CFO inside a client’s business? Would you be able to create — and justify — a strategic business plan? Do you understand the factors that enable your clients’ businesses to survive? And, which facilitates growth?

You’ll also want to think about what you enjoy doing, or what members of your team aspire to do, such as planning.

Finding your niche

Another method for figuring out what you’re best at is to carefully examine how you spend your time, and where your clients perceive the greatest value. Turning to a technology solution, such as practice management software, will help you see patterns within your current practice and understand which services are most in demand. You can also ask your clients directly: a simple survey can yield extremely valuable results by showing you what’s most needed.

Another method for figuring out what you’re best at is to carefully examine how you spend your time, and where your clients perceive the greatest value. Turning to a technology solution, such as practice management software, will help you see patterns within your current practice and understand which services are most in demand. You can also ask your clients directly: a simple survey can yield extremely valuable results by showing you what’s most needed.

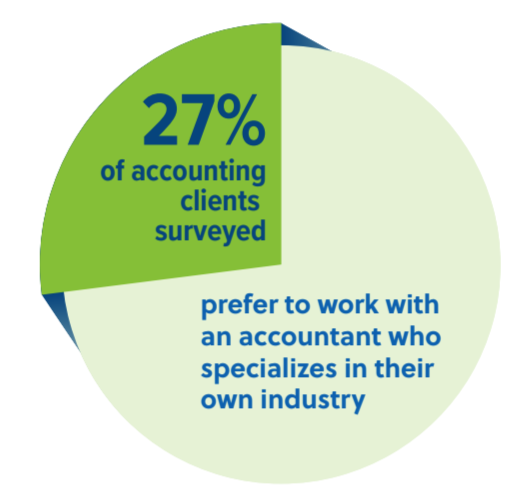

You may also want to consider whether it’s more effective to market yourself as a generalist or a specialist. Are there particular verticals or types of businesses that tend to choose you over and over again? Based on 27% of accounting clients surveyed, they prefer to work with an accountant who specializes in their own industry.

If the bulk of your client base already comes from a certain industry — say, professional services or engineering firms — it may be worthwhile to position your firm so as to capitalize on the expertise you’ve developed there.

Marketing your business online and implementing tools that enable you to offer digital services mean you will no longer be constrained by geography. If you’ve only served a local client base to date, now may be the perfect time to move beyond this model.

Building the right processes

It takes time and effort to create something new. If your firm is already busy and operating close to capacity, you’ll need to think carefully about where you’ll find this.

You may need to put systems in place that facilitate the transition by enhancing efficiency or automating repetitive manual processes so that your team has more time for higher-value tasks. You might also consider new billing models or systems. With an online payment portal, it’s easier to offer monthly retainer services that include automated billing. Or, you might offer bundled service packages. Anything you can do to streamline existing processes will open a larger window of opportunity to build higher-value offerings.

Launching new business models and pricing

Fast-growing accounting firms are seven times more likely to invest in marketing activities than their peers who are experiencing slow to average growth. These top performers tend to focus on differentiating themselves from competitors and highlighting the unique value they’re able to provide clients. When CPA firms decide to shift the balance of their service offerings, it’s a good time to rethink how they’re marketing themselves.

Fast-growing accounting firms are seven times more likely to invest in marketing activities than their peers who are experiencing slow to average growth. These top performers tend to focus on differentiating themselves from competitors and highlighting the unique value they’re able to provide clients. When CPA firms decide to shift the balance of their service offerings, it’s a good time to rethink how they’re marketing themselves.

The opportunities are nearly limitless for accountants and tax preparers who are successful at promoting themselves online. Doubling down on tactics like search engine optimization (SEO) or content creation can help you be discovered by large numbers of prospective clients, no matter where they — or you — are located.

If your accounting practice is serious about growing revenues — or bettering client retention rates over the long term — it’s wise to consider expanding your services so as to include higher-value offerings that can help your clients build stronger, more resilient and more profitable businesses. CPA firms looking not just to survive but to thrive in the coming years will need to step out of their comfort zones. They’ll also need to invest in new tools to drive efficiencies like OfficeTools. The rewards for doing so will be enormous.